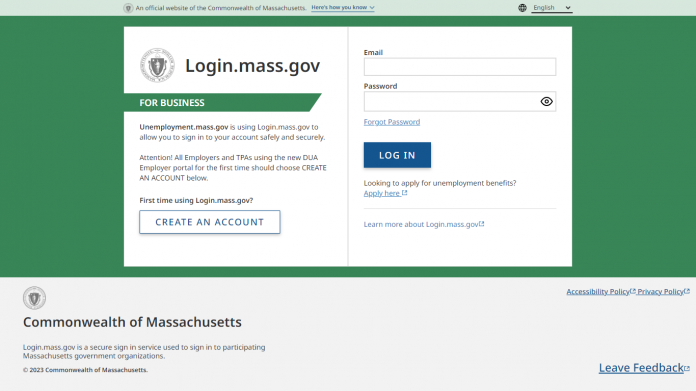

Massachusetts residents can log in to the UI Online system to access their unemployment benefits and manage their claims. Employers can also log in to the Unemployment Services for Employers portal to fulfill their responsibilities related to unemployment insurance. To access the MA-Unemployment Tax Account, individuals need to create an online account and follow the provided instructions, which include receiving an email with a username and a link to access the account. For specific login procedures and eligibility criteria, individuals should visit the official Massachusetts Department of Unemployment Assistance website or the UI Online login page.

What Information do i need to Log in to Massachusetts Unemployment Benefits

Please note that the specific login process may vary depending on whether you are a new user or an existing user. To apply for unemployment login mass, you can follow the steps provided on the Massachusetts Department of Unemployment Assistance website or the UI Online login page.

-

- Social Security Number

- Residence address, mobile number, and email address

- Complete birthdate

- Information about your employment history, including names and addresses of employers, dates worked, and job titles

- Military discharge papers (if applicable)

- Reason for discontinuing the job or having working hours reduced

- Employment last date

- Bank account number and routing number for direct deposit payments (if applicable)

The Maximum Weekly Benefit Amount

The maximum amount of unemployment benefits in Massachusetts is determined based on the individual’s average weekly wage. As of October 1, 2023, the maximum weekly benefit amount is $1,033 per week, which is approximately 50% of the average weekly wage, up to the maximum set by law. The maximum number of weeks for receiving benefits has been reduced to 26 weeks for new claimants in Massachusetts, down from the previous 30 weeks.

The Eligibility Criteria

You may not be eligible for unemployment benefits if you are an employee of a non-profit or religious organization, a worker trainee in a program run by a nonprofit or public institution, or a real estate broker or insurance agent who works only on commission. Have earned at least $6,300 during the last four completed calendar quarters, and 30 times the weekly benefit amount you would be eligible to collect. Be legally authorized to work in the U.S.

Documents those are Required to Apply

You may need to provide other specific information in certain situations, such as military discharge papers, reason for discontinuing the job or reduced working hours, and dependent children’s details if claiming them as dependents. It’s important to ensure that all the necessary information and documentation are available to prove eligibility before beginning the claim, as claims missing information may result in delays in receiving benefits.

-

- Social Security or alien registration number

- Most recent 15 months of employment history, including employer names, phone numbers, reasons for leaving, and start/end dates

- Email address (optional)

- Bank account number and routing number for direct deposit (optional)